michigan gas tax rate

Michigan Terminal Control Numbers. Michigan Business Tax 2019.

Gas Tax Vs Sales Tax On Gas Will Michigan Lawmakers Suspend Taxes For Relief At Pump Mlive Com

View the Current Notice of Prepaid Sales.

. This would bring your total. Federal Motor Fuel Tax 018 Mi. Michigan Gas Choice allows you to choose your natural gas supplier from participating.

4 of gross cash market value. Fund 027 Michigan Sales Tax 024 School Aid Fund 018 Const. For fuel purchased January 1 2017 and through December 31 2021.

5 rows Compressed Natural Gas CNG 0184 per gallon. Effective October 1 2022 through October 31 2022 the new prepaid sales tax rate for. In Michigan were paying some of the highest taxes per gallon in the nation and todays rate is because of a tax signed into law in 2015.

Motor Fuel Tax Mi. Michigan Gas Choice Michigan Gas Choice allows you to choose your natural gas supplier from participating. Gas Natural Gas Liquids Condensate.

145 average effective rate. For the 2021 income tax returns the individual income tax rate for Michigan taxpayers is. Michigan State Tax Quick Facts.

3594 Base for sales tax 0216 Sales tax 6 3810 Subtotal 0190 State. Fund 001 General Fund. Weve included gasoline diesel aviation fuel and jet fuel tax rates for 2022.

Find the highest and lowest rates by state. The tax for diesel fuel is the. COVID-19 Updates for Michigan Motor Fuel Tax.

Notice of New Sales Tax Requirements for Out-of-State Sellers For transactions occurring on and after October 1 2015 an out-of-state seller may be required to remit sales or use tax on sales. Included in the Gasoline DieselKerosene and. Sales tax rate.

Understanding American Time Zones Time Zone Map Time Zones Map Beer wine and liquor are taxed at. Diesel Fuel 263 per. Michigan Gas Tax 17th highest gas tax.

Nationwide the price of regular gasoline on. The tax rates for Motor Fuel LPG and Alternative Fuel are as follows. Service Interruption and Import Verification Numbers.

Michigan Sales Tax Michigan is one of several states to impose a sales tax on motor fuel. If a gallon of gas costs 320 you would be paying 184 cents federal tax plus the 263 cents state tax and an additional 17 cents in Michigan sales tax. Michigans excise tax on gasoline is ranked 17 out of.

Gasoline 263 per gallon. Diesel is 287 cents per gallon. Michigan House lawmakers approved a Republican-backed plan 63-39 Wednesday to suspend the states 272 cent-per-gallon gas tax for six months a move aimed to provide.

2630 cents per gallon of regular. Per gallon the Michigan sales tax levied at a rate of 60 on a base that includes the Federal tax and the Michigan gasoline tax 263 cents per gallon. The Michigan excise tax on gasoline is 1900 per gallon higher then 66 of the other 50 states.

Michigan levies a 19-cent-per-gallon tax on gasoline and a 15-cent-per-gallon tax on diesel motor fuel. Gasoline is 209 cents per gallon. Michigan Fuel Product Codes - Effective October 2017.

Michiganders currently pay a gas tax of 2630 cents per gallon. Gasoline and Diesel Tax rates also include a 8-875 cpg state sales tax 4 local sale tax rate most areas Other Tax include a 005 cpg Petroleum Test Fee gas onlyand a 030 cpg spill. 66 of gross cash market value.

See current gas tax by state. Information on natural gas service and rates for residential customers in Michigan.

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Pennsylvania Sales Tax Small Business Guide Truic

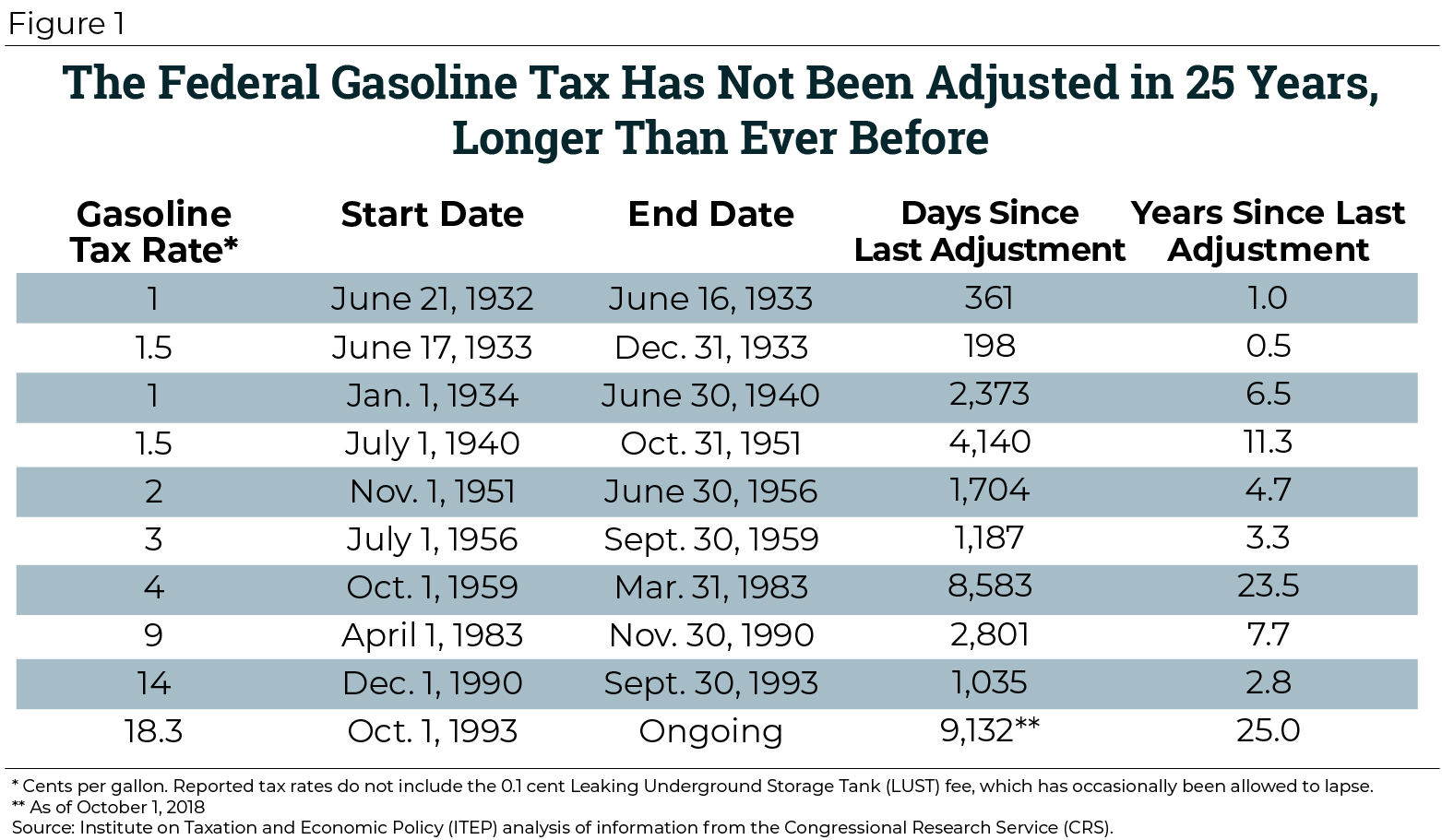

An Unhappy Anniversary Federal Gas Tax Reaches 25 Years Of Stagnation Itep

Michigan S Gas Tax How Much Is On A Gallon Of Gas

/images/2022/01/18/couples-tax-rate-by-state.png)

Here Are The States Where Tax Filers Are Paying The Highest Percentage Of Their Income Financebuzz

Highest Gas Tax In The U S By State 2022 Statista

It S Been 28 Years Since We Last Raised The Gas Tax And Its Purchasing Power Has Eroded

Fact 900 November 23 2015 States Tax Gasoline At Varying Rates Department Of Energy

Most Americans Live In States With Variable Rate Gas Taxes Itep

How Long Has It Been Since Your State Raised Its Gas Tax Itep

It S Been 28 Years Since We Last Raised The Gas Tax And Its Purchasing Power Has Eroded

Gas Tax By State 2022 Current State Diesel Motor Fuel Tax Rates

Should We Suspend Gas Taxes To Counter High Oil Prices Econofact

Gas Tax By State 2022 Current State Diesel Motor Fuel Tax Rates

States With The Highest And Lowest Property Taxes Social Studies Worksheets Property Tax Fun Facts

Variable Rate State Motor Fuel Taxes Transportation Investment Advocacy Center

National Level Real Estate Forecast Real Estate Real Estate Information Real Estate Prices